3 Reports Every Business Owner Should Review Monthly

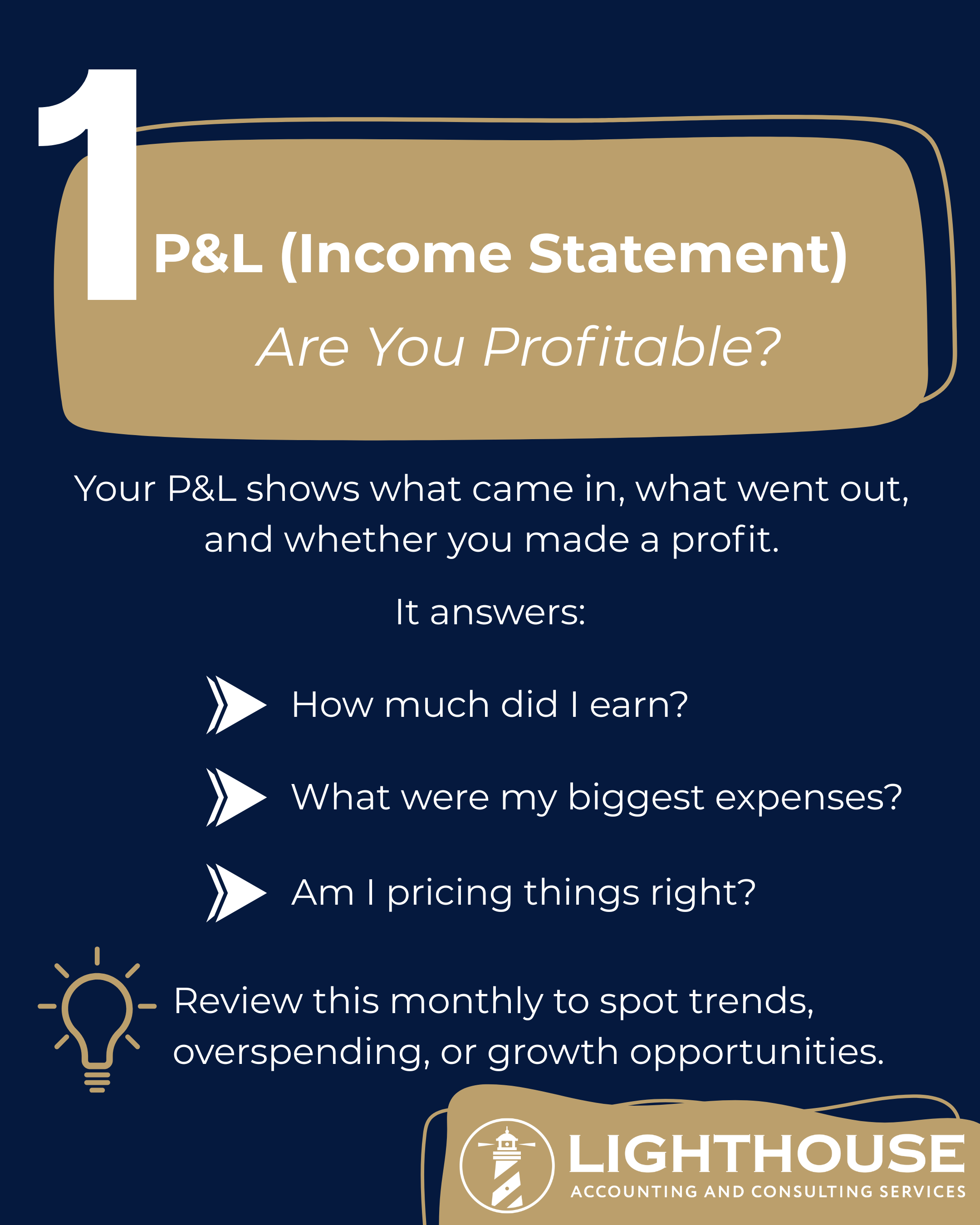

The profit and loss statement shows whether your business is actually making money during a specific period. Reviewing it monthly helps you track revenue, expenses, and margins before issues compound. Profitability is essential, but it’s only one part of the picture.

The balance sheet shows what your business owns, what it owes, and what’s left over. It reveals financial risks—like rising debt or weak cash reserves—that don’t always appear on the P&L. Monthly review helps prevent surprises and supports better planning.

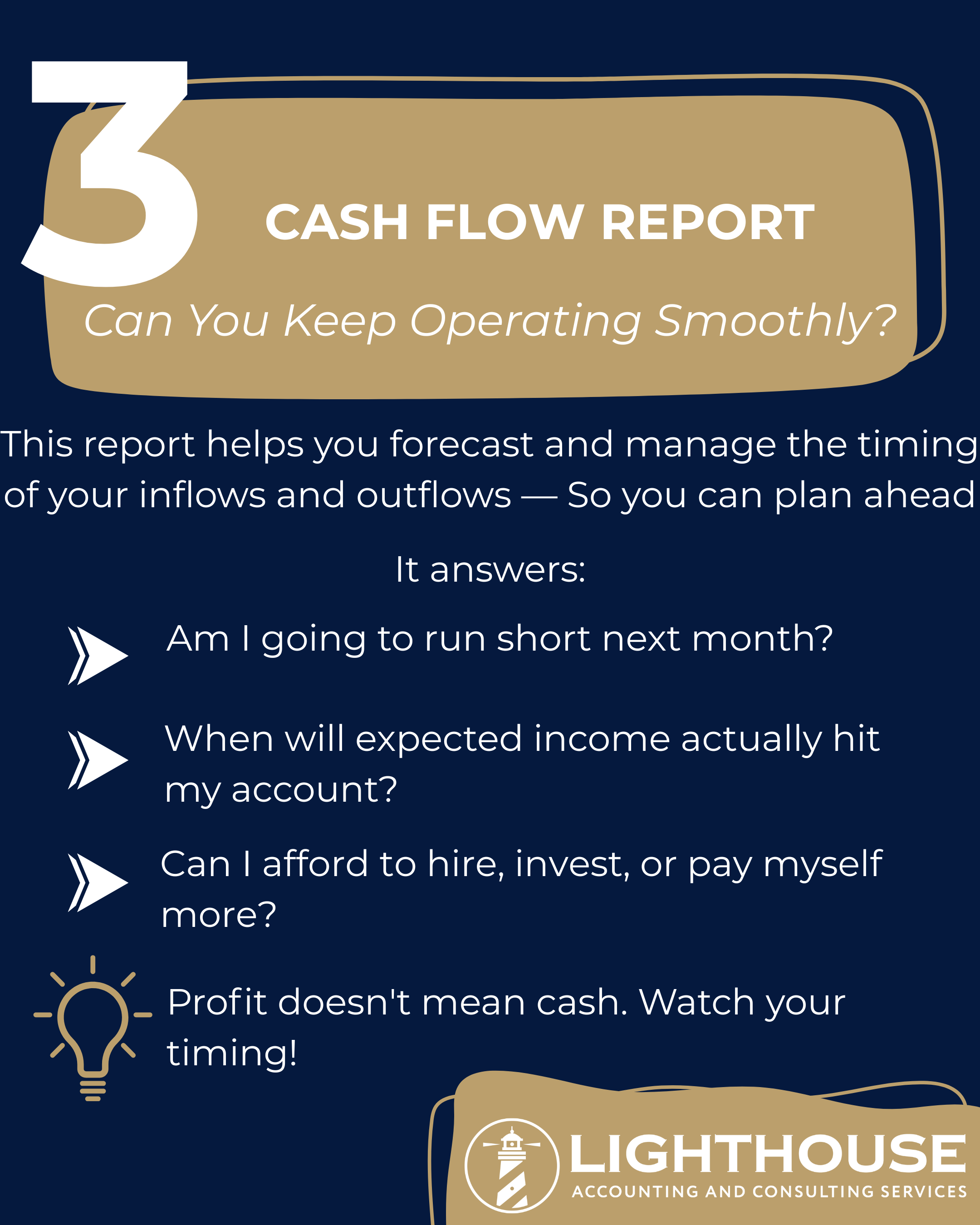

The cash flow report explains how money moves in and out of your business. It highlights timing gaps between income and expenses that can strain operations even when profits look strong. Reviewing cash flow monthly helps ensure you can cover costs without scrambling.