Roth IRA Income Limits: What High Earners Get Wrong

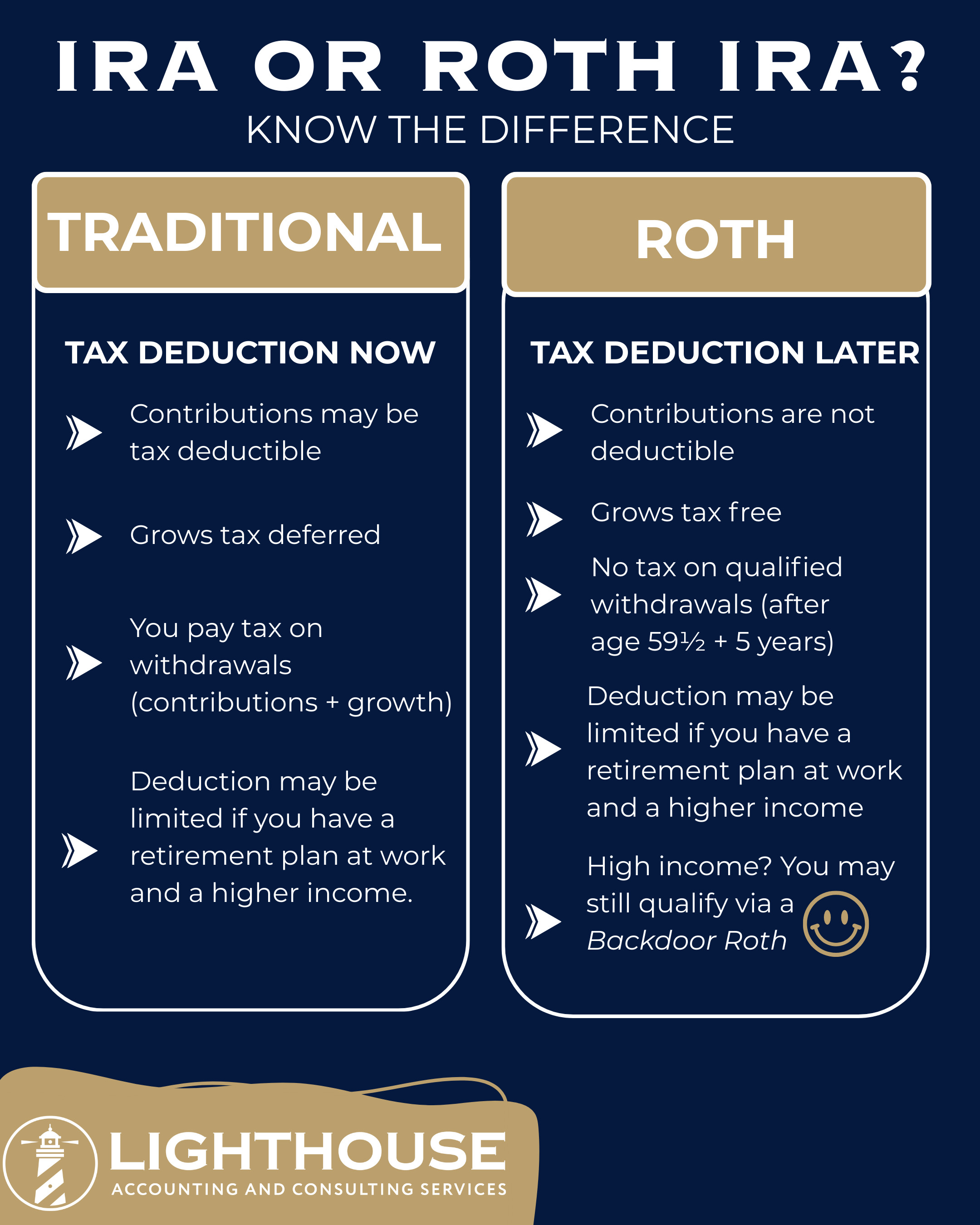

Choosing between a Traditional IRA and a Roth IRA isn’t about which one is “better” — it’s about when you want the tax benefit. Traditional IRAs may offer a tax deduction today, while Roth IRAs provide tax-free growth and withdrawals later, assuming eligibility rules are met. The right choice depends on income level, current tax rate, and long-term planning goals.

Understanding the trade-off between upfront deductions and future tax flexibility helps avoid one-size-fits-all decisions and ensures retirement contributions actually support your broader tax strategy.

Many high earners assume they’re completely shut out of Roth IRA contributions due to income limits. While direct Roth contributions do phase out at higher income levels, that doesn’t always mean Roth strategies are off the table entirely. The rules are more nuanced than most people realize.

Planning opportunities still exist depending on how income is structured, what other retirement accounts are involved, and whether certain conversions or workarounds apply. Assumptions often leave money on the table.

When income exceeds the Roth IRA contribution limits, the process shifts from a direct contribution to a two-step strategy that must be handled carefully. This typically involves contributing to a Traditional IRA and then converting those funds to a Roth IRA, while accounting for existing pre-tax IRA balances and IRS pro-rata rules.

Done correctly, this approach can preserve access to Roth benefits. Done incorrectly, it can trigger unexpected taxes. Understanding the mechanics before moving money is critical to avoiding costly mistakes.